Consulting Insights

Ovative Outlook October 2023

The media landscape is ever-changing. Each month, Ovative reports on the essential considerations for today’s marketers, and what action they can take to unlock success.

Consumer Trends

Trend: Consumers are feeling less confident in the economy than last month.

- University of Michigan and Conference Board survey measures of consumer confidence was down, marking two months of decline in how consumer perceive the economy. Most respondents cited rising prices, particularly for groceries and gas, as the inflation rate rose from 3.1% to 3.7% (+0.6pp).1 2 3

Trend: Consumer spending is slowing down and credit card debt is growing.

- As we referenced in last month’s Ovative Outlook, consumers are pulling back this fall after a busy summer shopping season. After household spending grew strongly (+0.8% YoY) in July, it was near-flat (+0.1%) in August. We expect this trend of declining consumer spend as consumers dealt with rising prices and looked to save up for Holiday shopping.4

- Consumers are racking up credit card debt as they struggle to afford higher prices and face higher interest rates. Total credit card debt and debt per household grew 8% from 2022 but is still lower than right before the pandemic and Great Recession. Most economists do not feel consumers are at a breaking point, but the growth in debt suggests consumers could be extra sensitive to higher prices as they look to spend this Holiday season.5

Consumer spending fell and we expect further decline as consumers save up for Holiday.

Action

- Marketers should expect a busy Holiday but focus on prioritizing value in their messaging to capture demand from consumers looking for worthwhile products amid higher prices and rising debt.

- Marketers should have a Buy Now, Pay Later strategy this Holiday, especially for brands with younger customers who will be looking to pay for pricier gifts over time.

Retail & Marketing Trends

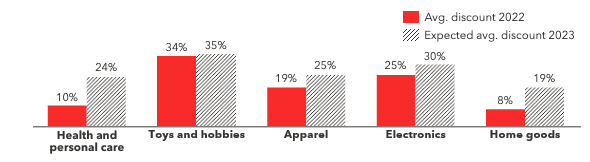

Deep deals across retail categories are expected this Holiday.

- To capture demand from price-sensitive consumers, retailers will offer record-breaking deals this Holiday, up to 35% off according to Adobe Analytics6

- Categories where major discounts are expected include toys (35%), electronics (30%), apparel (25%), sporting goods (24%) and bedding (11%)6

Deals are kicking off early, but we still expect consumers to anchor to key moments like Black Friday

- Big sales like Target’s Circle Week and Amazon’s October Prime Day are kicking off the Holiday season in October. This continues a trend over the last few years, in which consumers’ fears of out of stocks due to COVID-related supply chain delays pushed their Holiday shopping to early in the season.6

- While we expect substantial demand during early deals, we anticipate most consumer Holiday shopping to take place during key moments like Black Friday and Cyber Monday. As we referenced in last month’s Ovative Outlook, most consumers are planning to make big Holiday purchases ($100+) around Thanksgiving and Christmas.

CHART:

Holiday Discounts Expected by Category6

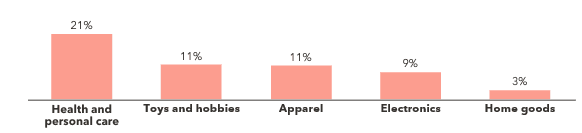

Sales Growth by Retail Category, Holiday 20227

Action:

- Marketers should offer competitive deals, focusing messaging on value and savings amid a challenging financial period for many consumers.

- Despite retail giants offering early sales events, marketers should be selective in when deals are offered to capture demand from customers at key moments like Black Friday and Cyber Monday.

Headlines We’re Watching:

Social media giants are continuing to experiment with paid, ad-free versions of their platforms.

Meta proposed charging $13 for its app in Europe, while TikTok is testing a $4.99 version. The subscription model provides platforms with a steady revenue stream while avoiding regulation and public scrutiny on data collection. However, it remains to be seen whether the model will catch on with consumers.8 9

Google revealed it often raises ad prices to meet revenue targets.

Former employees testified at Google’s Antitrust trial that during slower periods, Google raises ad prices up to 10% to meet revenue targets, usually without informing advertisers. The price increases support the Department of Justice’s case that Google dominates the Search advertising space with few repercussions.10

So, What’s Next?

At Ovative, we are keeping a pulse on what is happening in the marketplace so we can best keep our clients ahead of the curve. Ovative can help your brand understand what’s going on in the media landscape and, more importantly, how to take action and drive impact with your marketing spend. Connect with us to ensure your marketing is reaching its full potential!