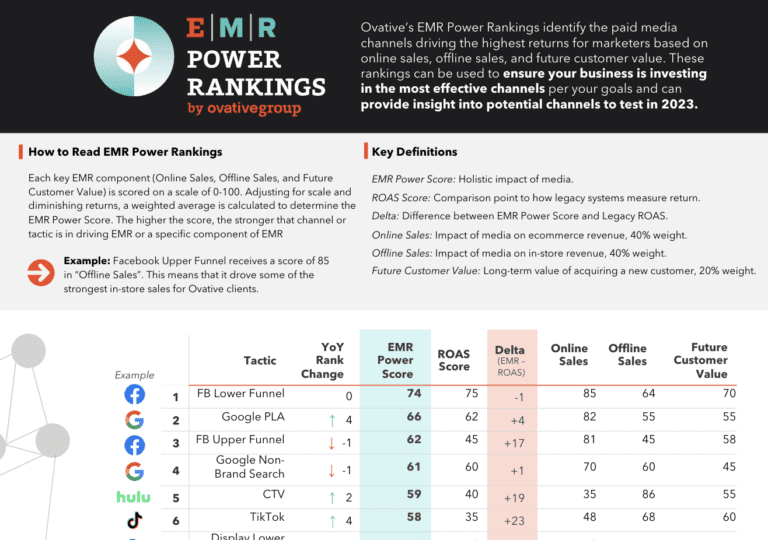

Budgets are tight. Marketers must ensure that every media dollar spent is driving profitable return. Enterprise Marketing Return (EMR) is the holistic metric marketers must use to understand the impact of their investments. Ovative’s EMR Power Rankings highlight the paid media channels driving the highest enterprise-wide returns for our clients so you can maximize your own investment.

Why EMR?

Marketers optimizing their media to legacy ROAS (Return on Ad Spend) are not understanding the full impact of their media on the bottom line and are wasting valuable budget. EMR incorporates online and offline revenue, future customer value, incrementality, and profitability into a single metric of success so marketers can easily understand if their media investments are achieving their goals.

Meet the 2023 EMR Power Rankings

Ovative’s EMR Power Rankings use real brand data to determine the media channels driving the highest returns for marketers. Marketers can use EMR power rankings to determine which channels are right for their brand.

Download the full EMR Power Rankings here.

Channel Takeaways

Based on this year’s EMR Power Rankings, we’ve compiled suggestions for channels on the rise, channels not worth the investment, and the best channels for online and offline sales.

The Underdogs:

Channels Marketers Could be Missing Out by Comparing to Legacy ROAS

Connected TV (CTV)

- Although CTV is thought to be synonymous with younger consumers, the channel is projected to reach half of the US population in 2023 in all age groups.1 Streaming powerhouses like Netflix and Disney+ have joined the AVOD landscape, and advertisers are following suit. CTV is catching up to linear TV with ad spending expected to be 50% the size of linear TV ad spending by the end of 2024.2 While most would assume that CTV only benefits digital revenue, CTV is notably driving revenue for our clients in store.

Streaming Audio – Spotify

-

Streaming audio’s national reach, targeting capabilities, and ability to drive both online and store revenue have given this channel a high EMR ranking. Time spent listening to streaming audio is increasing due to consumers’ abilities to multi-task while engaging. While interaction is growing, marketers can expect to see a plateau in growth as 74% of US Internet users listened to streaming audio last year.3

-

The five sites that dominate the landscape are YouTube, Spotify, Apple Music, Amazon Music, and Pandora. We believe that Spotify is the player to watch in the ad-supported space. Paid users had outpaced their ad-supported base for many years, but as of 2022, that dynamic has shifted with more ad-supported users signing on.4 Spotify offers engaging advertising capabilities such as audiobooks, Sponsored Sessions, and podcasts with dynamic or streaming-inserted ads.

Google’s Product Listing Ads (PLA)

Google’s PLA has increased EMR due to the transition to Performance Max and the addition of new customer acquisition targeting tactics.

Performance Max (PMAX)

- PMAX provided expanded reach as it unlocked access to Google’s entire network of platforms. We expect creative (image and video) to play a large role in optimizing performance now that campaigns cover all of Google’s ecosystem.

Acquisition Targeting

- The newly added acquisition targeting options have allowed marketers to focus more on new customers. We suggest utilizing acquisition targeting and conversion value rules to guide Google’s real-time bidding. We believe that conversion value bidding will continue to be a strong lever in Google’s real-time bidding to inform Audience, Geo, and Device targeting. Our experts have leveraged value bidding to assign revenue to in-store visits which helps optimize enterprise revenue.

Keep An Eye On:

TikTok

-

TikTok is the channel every marketer is talking about. For good reason! TikTok allows an opportunity for diversification away from the duopoly (Google and Meta) and provides access to the highly sought-after Gen Z audience.

-

However, it’s still a developing platform for advertisers. The channel is still functioning as an upper-to-mid funnel platform and is struggling to capture EMR impact as users are less likely to leave the platform. Investments in shopping capabilities could aid in this issue. Tactics that Ovative clients have seen success with are Video Shopping Ads (VSAs) paired with boosted posts (Spark Ads) and Countdown Stickers for key promotions.

- Looking ahead, TikTok is rolling out “Smart Performance” campaigns in 2023 that are similar to automation advertising tools launched by Meta and Google. As marketers continue to plan for 2023, they should keep an eye on the potential TikTok ban going through Congress. Although this is not likely to impact brands in the short term, there could be long-term impacts if action is taken to limit the platform in the US.

The Over Spenders:

Channels that Miss the Mark on Driving Enterprise Marketing Return

Affiliate – Coupon

- Coupon publishers are becoming increasingly less effective in the Affiliate space. This drop in EMR is due to a few reasons. The first is an increase in mid– and upper-funnel publishers entering the space, therefore making it harder to compete. The second is that when a customer uses a coupon, they already have high intent to purchase and aren’t net-new which means this tactic ranks lower in customer value. The third is that we have seen a lack of accuracy in the coupon codes with sites often showing expired and inaccurate codes, leading to a lack of trust with customers. We expect this trend to continue with coupon publishers being less effective and incremental due to their current tactics.

What’s a Marketer to do?

We suggest shifting focus to a full-funnel strategy that includes upper- and- mid-funnel partners paired with strong lower-funnel tactics like top loyalty partners. This will allow customers to find your brand at all journey stages.

Don’t turn off coupon partners completely! Ensure you are paying them a commission rate that ensures spend efficiency while still allowing you to control the copy and promotions within their site.

Google Brand Search

- Last year, many brands saw a decline in brand search volume and were fighting to bid for the same keywords. These factors ended up increasing CPC and impacting revenue. To calculate EMR, we interpret if a channel is driving demand or is just capturing existing demand. For brand search, we find many brands are overinvesting to capture existing demand.

What’s a Marketer to do?

In the short term, test lower CPC caps to combat the effects of inflated CPCs. At Ovative, we put an emphasis on a holistic approach to search, tracking brand interest overpaid, and organic tactics. When testing reduced CPC caps, we encourage brands to pay attention to the full picture of what’s driving interaction with their brand.

In the long term, we suggest testing brand search using EMR to see if the channel is providing incrementality. In general, we have found that closer alignment to upper-funnel media drives spikes in brand search demand. We suggest putting more spend towards these tactics and covering off on brand search to meet demand.

Bing Paid Search

- Although Bing is gaining search market share, increasing from 4% to 9% in the last four years, they are still behind Google, which has the majority with 84%.5 Microsoft is also lagging behind Google in paid media tactics. Google continues to evolve its campaign tactics, such as the launch of its new advertising automation tool Performance Max, to expand cross-network reach. Marketers can expect to see Microsoft continue to mimic Google’s campaign updates, but with a delay.

What’s a Marketer to do?

As proposed for Google Brand Search, in the short term we propose leveraging bid policies for the most efficient scale. In the long term, we encourage incrementality testing to validate EMR. For Bing in particular, we suggest spending enough to maintain coverage but no more. Media dollars might be better spent on Google.

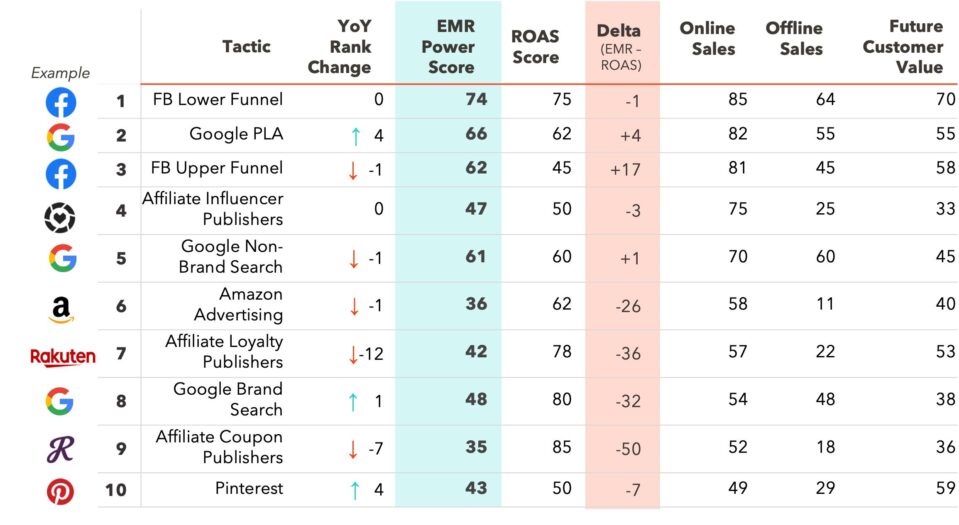

The Digital Dominators

Here are the Top 10 online revenue drivers based on their EMR rankings.

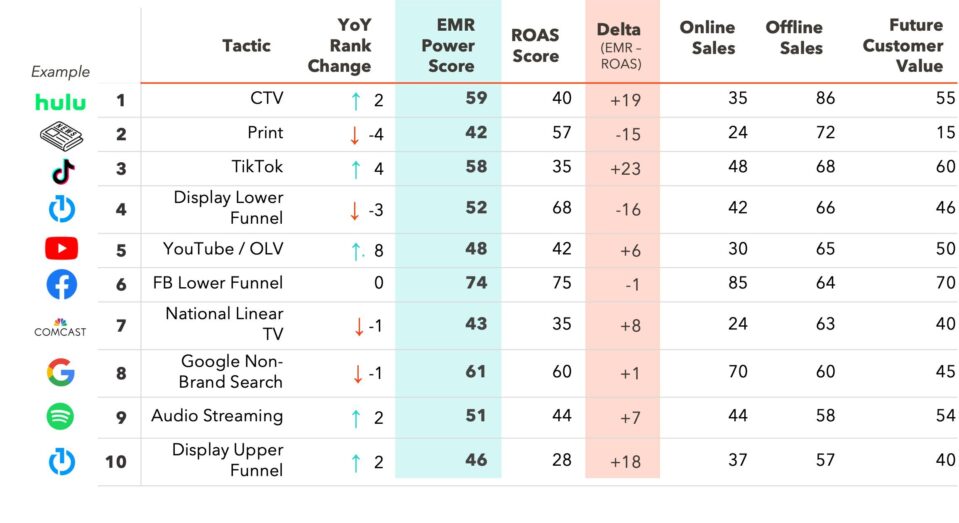

The Offline Operators

Here are the Top 10 store revenue drivers based on their EMR rankings.

Take Action

EMR Power Rankings are a powerful tool to help marketers make informed decisions. Let us help you optimize your media mix to exceed your goals this year. Ovative can help your brand understand the gap in your current marketing measurement and work to maximize your enterprise impact for the year. Connect with us to ensure your marketing is reaching its full potential!