Cross-Channel Integrated Planning

Ovative Trends and Performance Update: August 2021

The holiday season is nearly here, and marketers are being faced with a number of challenges as they plan for this important time. With persisting supply chain delays and a new wave of Delta variant cases, marketers need to plan ahead and pivot quickly to win holiday. Read on for Ovative’s take on how to prepare.

August Macro Trends

- Consumer confidence sank to a 6-month low, signaling that economic recovery has more headwinds as we head into fall. In addition, consumer sentiment, which measures consumers perceptions of their personal circumstances, came in 13% below expectations – providing the lowest read since 2011.¹

- Continued supply chain issues will result in higher prices and fewer choices for consumers this holiday season. Delta variant cases are increasing in southeast Asia, the heart of retail manufacturing, leading to factory closures the need to outsource production. Delays across the entire supply chain are pushing retailers to increase prices to compensate for increased freight and production costs.²

- Retailers are focused on inventory: less is now more. Supply chain issues and uncertainty in the economy have led retailers to offer fewer end-of season markdowns to capitalize on demand with lower inventory levels. In-turn, margin rates have been improving.³

What Trends Did We Observe Across Ovative Clients Last Month?

- Retailers are continuing to face supply chain challenges as the holiday season approaches and many clients are starting to think about reducing promotional messages or minimizing presence of promos in market given a possible shortage of inventory. Retail trends suggest clients should consider capitalizing on opportunities to secure higher margin rates by reducing end-of-season sales to help with strains the supply chain is causing.

- Clients are observing softness in store traffic as the covid 19 climate, recently fueled by the delta variant, continues to evolve and impact consumer behavior. So far, no meaningful changes to online shopping have been observed, but as consumer confidence declines headed into the fall shopping season, we could begin to feel consumers tightening their pocket-books and reducing shopping overall.

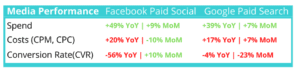

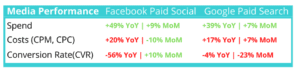

What Trends Did We Observe on Google and Facebook Last Month?

- Clients have started to launch media campaigns highlighting a seasonal shift with a focus on back to school, fall fashion and hybrid back to work settings.

- We are observing increased competition in the marketplace driving costs up and, in some instances, CVR down. Performance of these campaigns will likely be an indicator of consumer demand as we approach the holiday season.

- Increased costs and lowered conversion rates across Google were seen YoY. However, concern levels should remain low as increases in spend and impressions were the main drivers.

Ovative Cross Client Insights Data, August 2021⁴

How Can You Turn These Insights Into Action?

Promotional flexibility will be key. As marketers combat decreased consumer confidence and supply chain delays, they need to incentivize shopping while staying on top of inventory shortages. Marketers should consider running flash sales or shorter promos to boost holiday sales performance and create a sense of urgency around limited product availability. Planning for and quickly reacting to supply chain disruptions throughout holiday and into 2022 will be critical for success across all industries

Adjust messaging to match changing consumer behavior. Monitor trends throughout the season to find whether consumers are favoring online shopping, or whether they are heading back into stores, so that you can adjust your brand’s messaging to your customers’ preferences.

Carefully consider which products to include in sales or markdowns. Exclude products that have lower inventory levels, and capitalize on increases in margin while preparing for longer-term impacts to your business.

As you continue holiday preparations for your brand, continue to monitor trends, and use these tips to plan around changing consumer confidence and supply chain delays.

Ovative is a digital-first media and measurement firm seeking to transform the measure of marketing success. At Ovative, we help brands move the needle. We are curious. We value your brand. We want to see you succeed. Connect with us to learn more!

SOURCES

1 | Consumer Confidence Index, August 2021

3 | WSJ, Clothing Retailers Boost Profit Margins by Offering Fewer Markdowns

4 | Ovative Group, Cross Client Insights Data, August 2021